There’s always one who says…

“It’s different this time” is an oft repeated phrase. This is normally followed by a stab at justification such as, “Just look back over the past three years, markets are behaving differently.” And now the good news, it’s never different. Markets never misbehave. Markets simply behave. As David Booth chairperson of Dimensional Fund Advisers explained, “Think of public financial markets as a giant information-processing machine. When bad news comes in, prices drop. When good news comes in, prices rise.” The stock market will go up and down. It always has; it always will.”

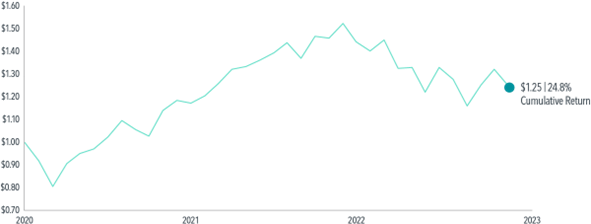

So, let’s look over the past three years. Spoiler alert, it’s not pretty. It’s easy to have your confidence dented by events like this, no wonder some investors are perplexed.

- 2020 a global pandemic, most of the known world was locked down.

- 2021 signs of recovery begin to emerge.

- 2022 war in Europe, energy prices surge, inflation and interest rates soar.

Despite enduring a global health pandemic, partial recovery, then war in Europe, historically high inflation, soaring energy costs, rising interest rates and a cost-of-living crisis, the US stock market as measured by the S&P 500 index was 25% higher. Why the US? Our portfolios allocate funds to replicate global market scale. That results in the US representing approximately 60% of our equity holding.

The Big Picture

Growth of $1 invested in S&P 500, January 1, 2020–December 31, 2022

Looking at year-by-year returns and not medium to longer terms distracts rather than informs. Looking at the total history of returns creates a more balanced, and frankly reassuring picture.

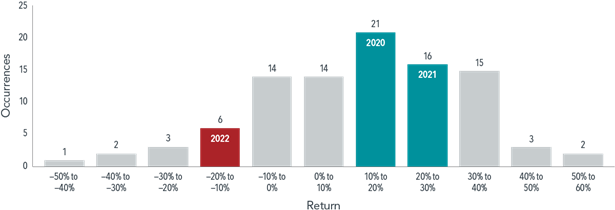

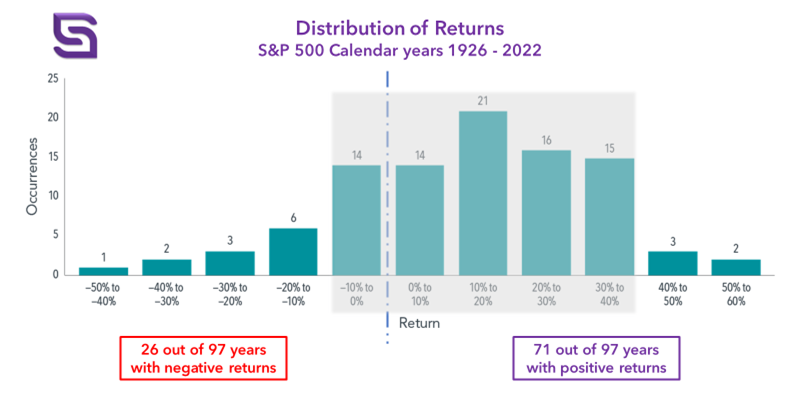

If we take a different look at market returns, it helps to see that this time is not different, despite some commentators reporting otherwise. Let’s look at the range of returns from the US stock market over 97 years, from 1926.

Seeing the spread of returns highlights a number of important facts. Firstly, returns lean toward positive outcomes being more common. In fact, there have been 71 years of positive returns compared to 26 years that were negative.

The majority of returns are between –10% and +40% and looking at things this way gives a more accurate sense of the range of likely returns, rather than a prediction. If we look specifically at the very different returns markets have delivered over the past three years, we see they are very much in line with what we’ve seen in the past. Nothing new here.

The majority of returns are between –10% and +40% and looking at things this way gives a more accurate sense of the range of likely returns, rather than a prediction. If we look specifically at the very different returns markets have delivered over the past three years, we see they are very much in line with what we’ve seen in the past. Nothing new here.

Distribution of calendar-year S&P 500 returns, 1926–2022

The returns in 2020 and 2021 were positive, with 2022 being negative. Two steps forward, and one step back if you like. Nothing unusual in that. Life has always had a tendency to ebb and flow. It’s life’s own ceilidh dance. Two steps forward one step back, spin around, repeat. Even if you are like me with two left feet, we can all learn. After you take a step or two backwards, you know at some point you are going to be moving forward again. Once you get comfortable with the steps and the rhythm, any fear of being off the beat soon ebbs away.