John F Kennedy once said, “The one unchangeable certainty is that nothing is certain or unchangeable.” This is particularly true when it comes to investing; there is very little that is certain. The media, however, often makes forceful claims about the efficacies of alternative investments, especially gold. In times of volatility, the media switches its attention to the gold price and the implied promise of glistening profits via superior returns.

What is it about gold as a financial refuge? It doesn’t produce any income and it’s a purely speculative investment. Why does it always emerge from the emergency telephone box resplendent in its financial Superhero costume in times of global turmoil?

There has always been a fabled, magical quality to gold. Gerald Loeb, a famous US investment guru, captured it like this: “The desire for gold is the most universal and deeply rooted commercial instinct of the human race”.

At Stewardship Wealth we believe ‘instinct’ is an investor’s most destructive impulse. It causes people to believe they can time markets based on “gut feel” or misplaced confidence in the media machine that churns out “hot stock tips” and identifies “top pandemic shares” plus the ubiquitous “winners and losers”. Here are our thoughts:

Making credible investment performance comparisons are always challenging, complex, and contentious. I recall a heated debate in one fund management team meeting about comparing funds and if they had delivered their performance objectives and how they stood up to the competition. One experienced manager said, “you can demonstrate your fund outperforms any fund on the planet… so long as you get to decide the time frame!”

With any investment comparison, it’s important to consider the time frame. Gold is not a ‘sure thing’ investment. It has its moments, especially when things are looking bleak. But over the long term, it’s returns fall short of both shares and bonds. It only works effectively if you know in advance what markets will do, get in quick, and then get back into markets when they hit the bottom. In other words, you need to be able to time the market, and we would struggle to fill a phone box with those who can do that consistently.

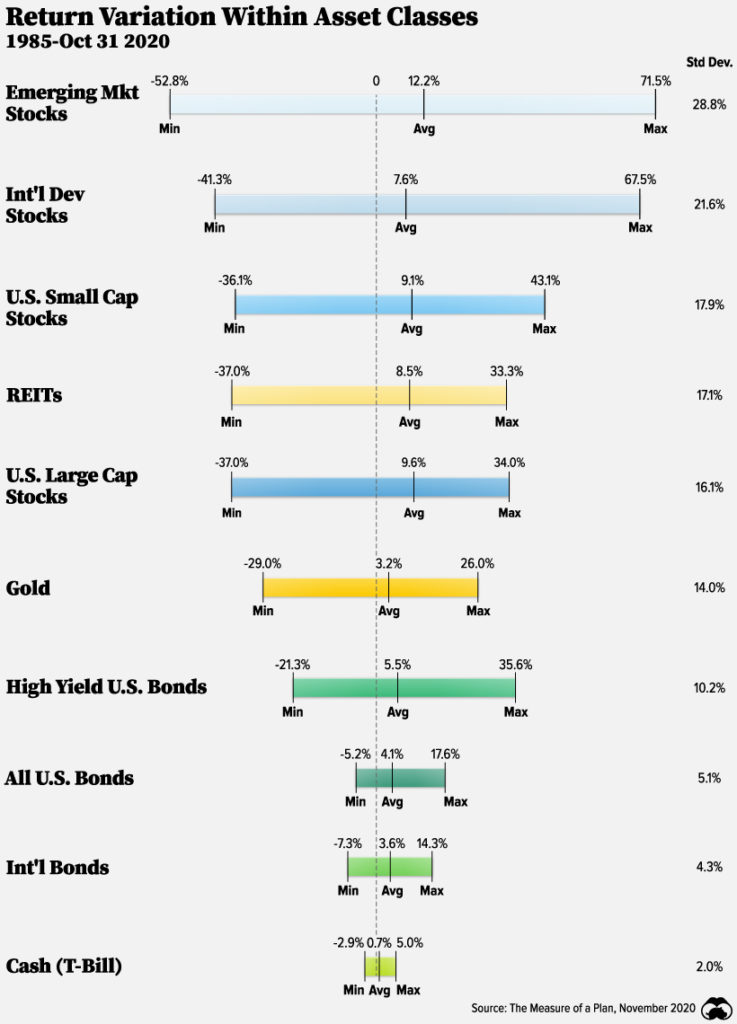

So, let’s look at the results from 35 years of sector data recently issued by Visual Capitalist. This report considered the historic returns and relative positions of a range of ten asset types, from Emerging Market shares at one end of the risk scale to cash deposits at the other. It shows some interesting investing outcomes and highlights the unpredictability of even “safe haven” assets such as gold. The returns below are after taking US inflation into account, so ‘real returns’:

Looking at the average real (net of inflation) returns over 35 years gives us a strong indication of long-term return expectations. The coloured bars above show the range, or distribution of returns, you would have lived through as an investor during those 35 years. Gold returns ranged from -29% in its worst year to 26% in its best year. Probably a wider range than you would expect from a “safe haven” investment. We can see from the report that gold’s average real return over 35 years is 3.2% per year. This is lower than the return from international bonds, which are also a less volatile option. The range of returns from International Bonds was -7.3% to a high of 14.3% in a year, a much narrower spread.

The problem with investing in gold is that you need to know in advance when market conditions might require gold’s short-term interventionist qualities and, as we know, there’s still space in the ‘phone box’ for those in possession of this rare talent.

Being selective is manipulative and damaging. It creates damaging, false assumptions and has the potential to mislead investors. At Stewardship wealth we look for solid evidence that any prescribed process has long term integrity. We want a robust, consistent body of evidence to base our decisions and underlying philosophy upon. We made a very deliberate choice to follow the academic research route and look at the longest, most detailed data set available when making any performance statements.

We don’t invest in gold as a commodity. We do, however, hold shares in several global mineral and gold mining companies within our portfolios.

So, in summary…

Gold is a useful diversifier and hedge bet. It produces no income, and its price is based on speculation. We prefer to focus on where returns come from, and speculation is not on our list.

We don’t invest directly in physical commodities. However, we hold shares in the companies that find, mine, and refine raw materials. These holdings will broadly cover the gold and mining sector providing a wide opportunity set plus the benefits of global diversification.

All that glitters is not gold, scratching the surface through a little diligent research may just show it to be “gold plated”.