“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today” – Laurence J. Peter

We know markets are unpredictable, but surely economic health is a sure-fire way of predicting the direction of share values? If only it was that simple. Let’s look at a 2021 report by the: International Monetary Fund, Macrotrends, S&P Dow Jones, the US Bureau of Economic Analysis, and the Federal Reserve Bank of St Louis. The findings highlight the disconnect between expectation and fact.

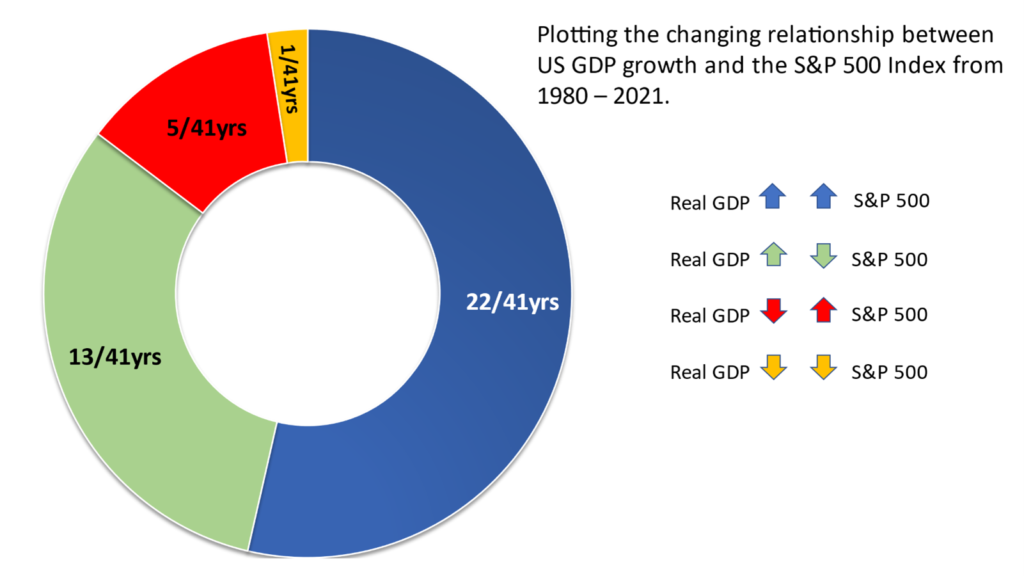

They found there is a complex “on/off” relationship between Gross Domestic Product (GDP – essentially economic performance), and the US stock market which can occasionally lead each going their own separate ways.

Relationship in Growth Between the US GDP and the S&P 500

While we may expect the stock market and economy to grow as one, we see that for thirteen out of the forty-one years sampled, the market fell despite a growing economy. Equally, 2020 was the only year with a rising market as GDP contracted. In five of the six years with negative GDP growth, the market was positive.

Returning to 2020, the year of the “Great Divide”; US unemployment rose from two million to twenty Million as real GDP declined 3.5%, while the S&P 500 Index returned almost 15% net of inflation – a record high. Meanwhile, 2008 was the only year where both the market and the economy were “in the red”.

So why does the stock market not necessarily mirror what happens in the economy? They are very different metrics with opposing outlooks. Stock market pricing reflects the long-term views of the market, focussing on future earnings potential. In contrast, GDP growth measures current activity.

There are many advisers who try and predict the market direction based on forecasts, predictions, or hunches. However, in our experience, this rarely works out as expected. At Stewardship Wealth we prefer solid, robust evidence as to where returns come from, not opinions or speculation.