Challenge: Explain (simply) recent market dynamics and possible outlook.

So here goes.

Recent regulation, the snappily titled MiFID 2, created the requirement for discretionary fund managers and advisers providing portfolio management services to inform clients if their portfolio value falls 10% or more during a quarterly reporting period. But to what purpose?

For us the jury is still out on whether this is of real value. Getting a piece of news like this can damage confidence in the long-term plan. Market commentary, speculation and hype can put investors off balance and feel as though they have to act, to do something. They don’t.

We do not have discretionary powers so are not required to report any such impact on valuations.

But, shouldn’t clients be better informed? Absolutely, but being better informed is not the same as pushing more information through letterboxes or more email traffic. If information is personally relevant and in context, then yes it can add value.

Behavioural studies show that clients, especially those with limited experience of volatile markets, may feel pushed into selling. All to protect their savings which have already fallen by what many may feel is a significant amount.

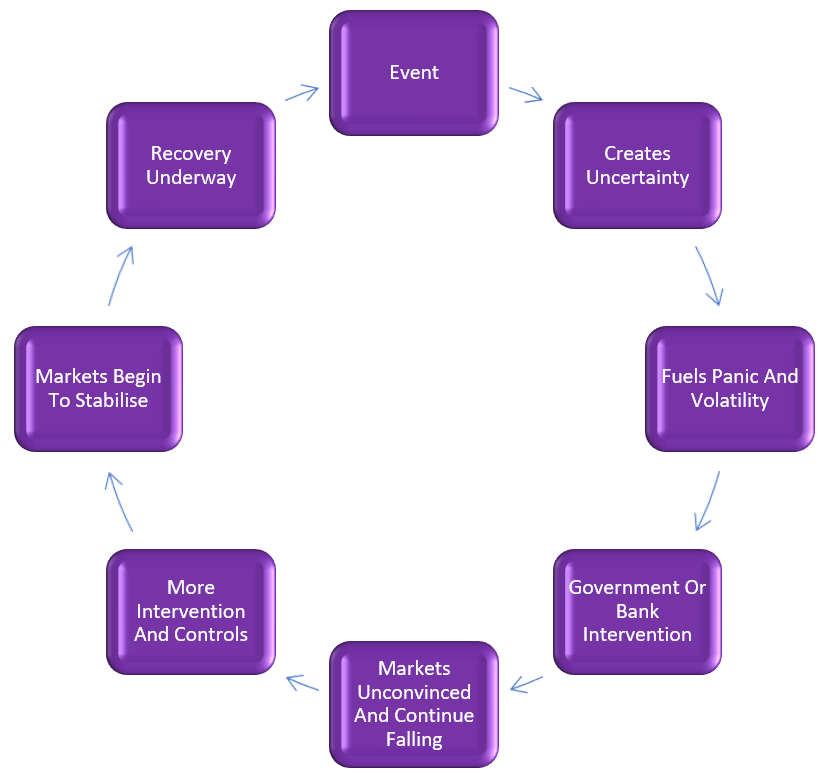

History shows us the impact of emotional or impulsive decisions in the midst of volatile markets. Investors who waited on the side-lines and watched as markets struggled through previous financial crises have been rewarded for this patience.

Let’s explore the facts:

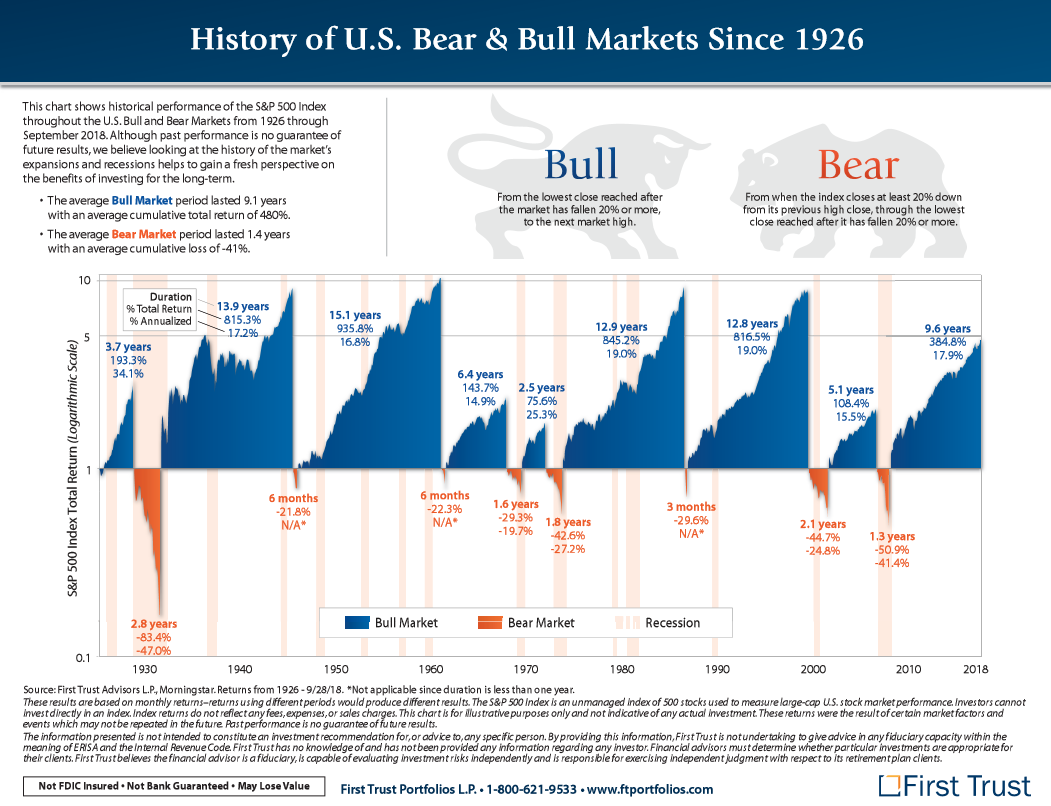

Firstly, there are a few obvious observations. The proportion of blue versus orange. Although no doubt at the time these bear (falling) markets were deeply unsettling and anxious periods for investors. Looking back, we see the most painful market falls were followed by the most rewarding rebounds. If you retained discipline during uncertain and volatile markets you have been richly rewarded. We only control what we can control. The long-term plan and cash-flow models are the key control components, not trying to time or second guess the market.

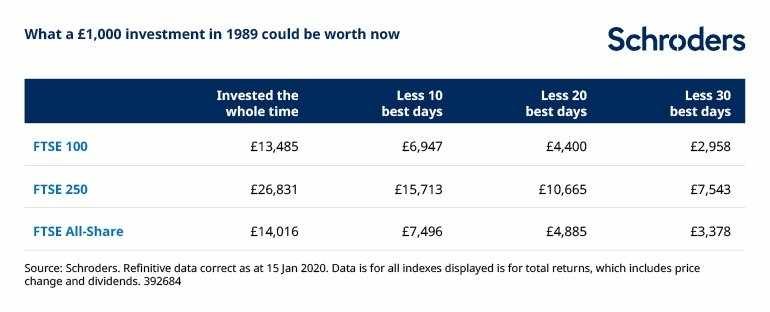

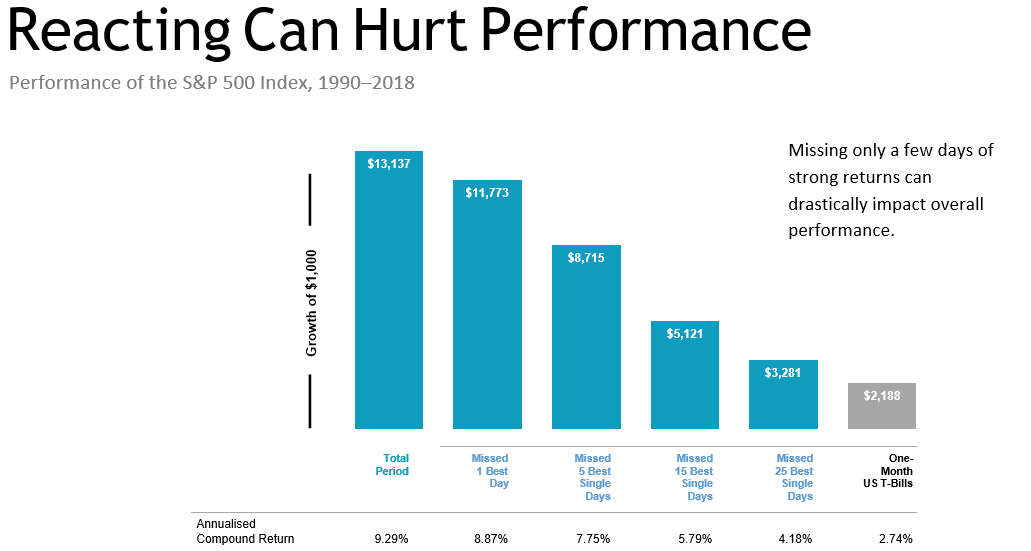

In “successful” market timing you have to get the exit timing right, then the timing of getting back in. Let’s not forget the costs involved. As you can see from the chart the difference between winning and losing is significant, and we suggest worth waiting for.

If there are any questions please just let us know, we are happy to discuss anything that concerns you.