“The goal isn’t about more money. It’s about living life on your terms.” – Will Rogers

A recent survey* exploring “who has a financial adviser” reported that 83% of respondents felt financial advice wasn’t for them. I struggle to come to terms with this idea. What assumptions are people making about financial advice? We prefer to describe what we do as financial planning. We believe it goes beyond simply providing advice.

Many have said, of financial advice, that:

Education is one answer to combat the lack of understanding and awareness regarding financial planning. We, along with others, are pressing for more financial education, especially in schools. If children and young adults can develop a good, responsible relationship with money early, it leaves them better equipped to deal with the financial decisions they’ll face through life.

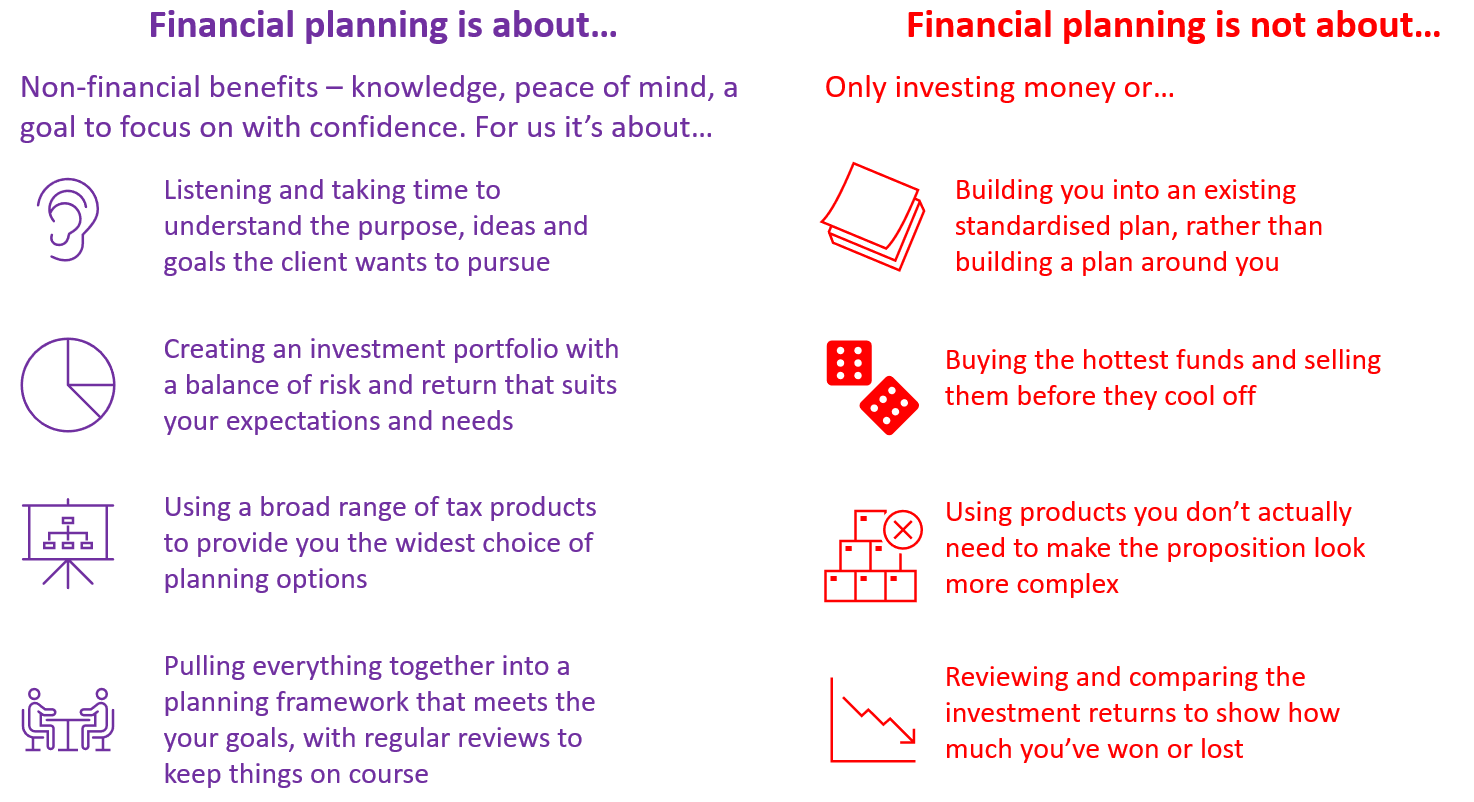

Perhaps financial planning is simply misunderstood. For us, it’s about delivering non-financial outcomes such as peace of mind, reassurance, and confidence that a client’s future plans are achievable.

We have seen first-hand the difference financial planning can make. People quickly realise it’s not about making more money; it’s much more than that. It’s about helping people establish their life plans and goals, and then helping to ensure that they fulfil them. We fuse purpose and planning together by designing a financial model, testing it to breaking point, and then pulling everything together into a workable plan. But it does not stop there. We ensure our regular reviews make sure we stay on track, and if things change, we can quickly re-align goals and plan.

People often ask me, “How’s the job going?” followed by, “What is it you do exactly?” When I describe why we do what we do, and how we do it, most reply, “I hadn’t thought about financial planning like that, I thought it was all about people with money investing it to make more!”

What is surprising is the number of people, who many would regard as having “made it”, that worry about sustaining their lifestyle throughout their retirement without running out of money. Financial planning, especially lifetime cashflow management, is a crucial part in reassuring people that they can look to the future with confidence.

We love working with a broad range of people – from the financially curious, the questioners, the challengers to those who class themselves as financial novices. It keeps us on our toes, and constantly raises the bar, setting new expectations and testing our creativity, technical competence, and service quality.

Eudaimonia is a Greek word describing a contented state of being happy, healthy, and prosperous; sometimes summarised as “human flourishing”. To have this as an outcome for financial planning is pretty audacious, but it sums up what we are trying to achieve. To allow our clients to enjoy life on their own terms, worry-free.

We always start from “why” a client feels they need to plan for their future. For us, it has always been about the purpose behind the planning. It is true that investment plays a major part in financial planning, but it is simply one of the tools we use within the financial plan. More important is the partnership, collaboration, and the relationship that comes from spending time together wrestling with and explaining the options and opportunities; educating people to make more informed financial decisions. It’s about creating the financial foundation and confidence that lets individuals “live life on their terms”.

*The online survey was conducted by Atomik Research for advice firm Progeny among 2,003 respondents from the UK between 4 and 6 November 2020.