Doughnuts – The optimist sees the dough ring. The pessimist sees the hole.

The focus on climate change and developing strategies for sustainable living is inescapable. The global community’s response has been patchy at best. The UK government has set ambitious carbon reduction targets. However, while targets are one thing, a cohesive collaborative strategy that delivers sustainable improvement with successful implementation is another. Inspiring the global community to adopt major behavioural change in pursuit of carbon reduction targets is an almost impossible goal, yet it must be pursued.

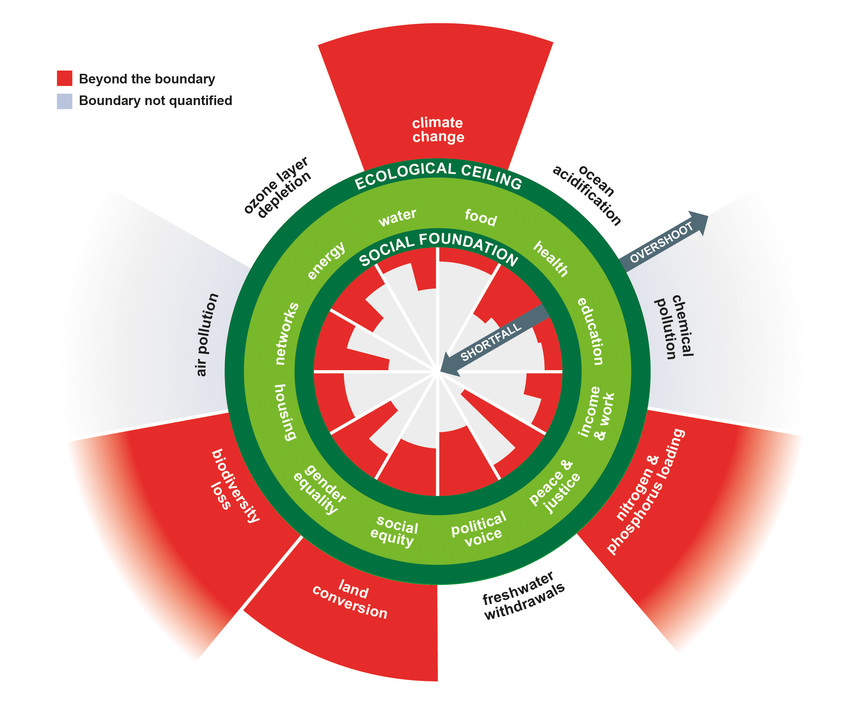

Economist Kate Rawson, author of ‘Doughnut Economics’, argues against the drive for continuous, unfettered economic growth which cannot be supported by the world’s resources. Using the diagram below, she urges consideration of capping growth at levels that will support what the United Nations has framed within its Sustainable Development Goals (the doughnut’s inner edge) but remaining within what the planet can sustainably deliver (the doughnut’s outer edge).

Doughnut Economics Diagram:

In effect, Rawson rails against the present Gross Domestic Product “arms race” towards uncontrolled economic expansion at any cost. Let us be clear, capitalism has been massively beneficial and fuelled human development and opportunity, but it’s a game that has been played on a far from level playing field.

Let’s just consider what this could mean for us in terms of future lifestyles. Experts suggest that to achieve genuine carbon reduction energy consumption must fall. Therefore, less travel, less global trade, and more local. Therefore, less strawberries from South Africa, blueberries from Peru, and lamb from New Zealand on our supermarket shelves. And, therefore, heat exchangers instead of gas boilers (costing the Treasury an estimated £37bn in annual fuel duty according to a recent study).

Renewable energy makes an important contribution towards carbon reduction, but how much impact has investing in sustainable production created? Environmental author Ed Gillespie shared some unsettling statistics, “In 2009, fossil fuels made up 80.3% of the global energy mix. By 2019, all the efforts of green campaigners, consultants, policymakers, business, and, yes, investors, had reduced that to 80.2%”.

The issue is that renewables are not filling the gap left by lower fossil fuel use, they are adding to it.

What about the cost of this new sustainable behavioural model I hear you ask. The cost implications are massive with one estimate suggesting a global annual budget of $2.4 trillion as being enough to make a significant difference. So, where is the funding going to come from? The money is there – consider the almost $12 trillion raised in response to the Covid-19 pandemic.

Whatever the outcome of COP26, businesses will respond. New technologies, new skills, and new opportunities will emerge for employees and entrepreneurs to create solutions, provide employment, and raise living standards.

Investment continues to be dominated by environmental, social, and sustainable themes. It matters where money is invested. Should we fund deforestation, fossil fuel extraction, or industries tackling decarbonisation at scale? These and others are some of the challenges Stewardship Wealth are focussed on in our environmental, social, and governance (ESG) investment framework. We want to provide access to funds that invest in companies committed to growing responsibly, sustainably, and inclusively. To do so, we need a closer look at what goes on behind the scenes within fund management groups and if their internal behaviours live up to their external practices. We need more consistent research and evidence that supports behavioural change.

What does this mean for Stewardship Wealth? Here are some high-level themes:

- Growth: we want to go beyond a simple bottom-line focus to include growth in wider prosperity and well-being, especially enhancing mental wellbeing through the dignity of working and providing for families.

- Social Inclusion: equality of opportunity, acceptable living standards, and narrowing inequalities among genders, ages, ethnicities, and family backgrounds.

- Sustainability: we aim for environmental resilience, reducing climate risk, and preservation of our environment.

Recently we were delighted to be invited by Dimensional Fund Advisers to join a Sustainability Council of advisers to participate in discussions supporting the ongoing development of sustainable investment practices. This will provide insights, evidence, and processes we can implement within our True Wealth Portfolio strategy.

We continue to look at expanding our sustainable content within our portfolios. Our most recent Investment Committee review looked at several options, but concluded that there was insufficient track record or data to support making fund changes at the time. The debate continues…

Final thought. Kate Raworth’s Doughnut Economics TED talk is well worth checking out, which you can access by clicking the link HERE.