Origins and the pressure for change

Hello, and welcome to our first Deeper Dive Issue, a series where we look at key areas of interest in more detail. We wanted to begin by unwrapping ESG. The most successful and popular investment style in recent times, ESG investment focuses on seeking out companies whose core business priorities align closely with improving Environmental, Social and Governance practices and outcomes.

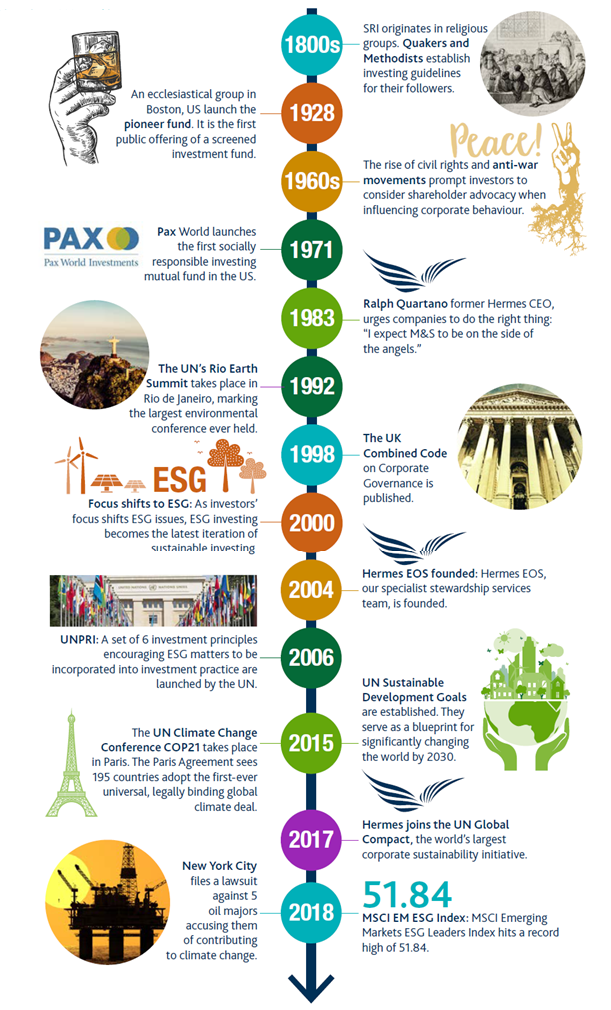

The chart below is taken from a Hermes Investment Management Report published last year and brings home the fact that personal morals and values have played a part in shaping investment thinking and selection processes for over 200 years:

Source: Thomson Reuters, Financial Times, The Guardian, United Nations and Hermes as at January 2018.

The chronology demonstrates that ‘conscience investing’ is not just a fad, but has been around for a long time. Moral pioneers created ‘ethical funds’ that simply excluded what became known as ‘sin stocks’ – companies involved in alcohol, tobacco, armaments, and pornography. Attitudes then began shifting towards environmental considerations which ushered in more ‘Sustainable Investment’ processes. These focussed more on active corporate engagement and brought climate change and environmental impacts to the forefront. The main targets were the energy, mining, logging, and food production sectors.

Growing pressure for change gathered momentum and culminated in the UN launching their ‘Six Principles’ in 2006. This was a nudge for investors to combine Environmental, Social and Governance into core values for consideration when assessing company performance. It goes beyond simply looking through a company’s financials and results, it explores and sifts the methods, attitudes, and practices employed in pursuit of profit.

As global awareness of CO2 emissions and its impact grew, momentum shifted toward climate change, and as the scientific evidence became irrefutable, global conferences such as Rio’s Earth Summit, and the Paris Accord took place. In Paris, 195 countries committed to work together towards lowering carbon emissions and embracing more sustainable working practices. It would also be safe to say that Sir David Attenborough almost single-handedly caught the world’s attention and intensified our awareness of plastic pollution through the BBC’s Blue Planet II series.

In 2015 the UN issued a report containing 17 ambitious ‘Sustainable Development Goals’ which were agreed by all 195 member countries. Here are the goals agreed:

Achieving measurable change for such an initiative at this scale is challenging. Furthermore, is it possible for us to bring a genuine credible answer to the following long-held concerns surrounding non-traditional, sustainable or ESG investment?

- Will there be a drop off in investment returns by limiting investment options?

- Will there be sufficient interest from investors to launch ESG funds?

- Won’t these funds be too expensive due to the additional research required?

To date the answers have surprised many, if not most:

- The evidence suggests performance appears to improve.

- More new funds are being launched integrating ESG principles to meet demand.

- Most fund groups are integrating research functions so there are marginal cost differences.

- Investors are actively selecting ESG funds in place of more traditional solutions.

- Investors believe companies adopting these principles are better run and therefore less risky.

- Regulation has begun to build ESG compliance into mainstream thinking.

- Many major asset managers and large institutions now lead ESG endorsement.

Our response

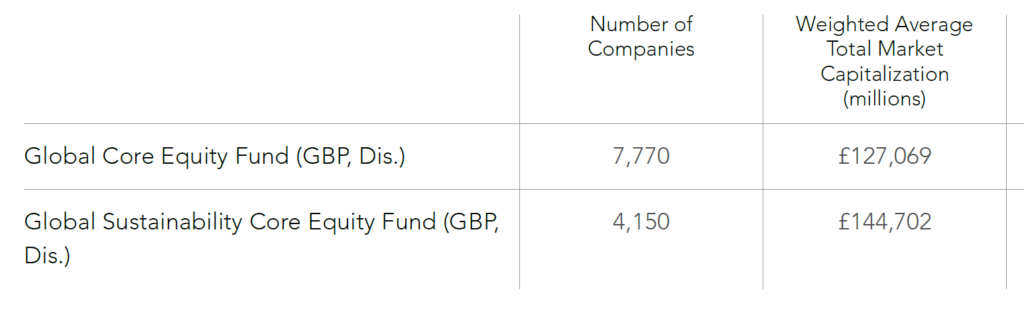

We have been working closely with several fund groups to build an ESG policy which retains our conviction of ‘evidence -based’ or ‘systematic investing’. We have begun the transition using our Core Wealth portfolios and replacing the ‘Dimensional Global Core Fund’ with its ESG twin, the ‘Global Sustainable Core Fund’. The basic differences are shown below:

Equity Characteristics

As expected, the introduction of an ESG overlay has reduced the number of holdings. However, as shown below, it retains our key principles of global diversification, with tilts towards the smaller, value companies with higher profitability, and funds with lower charges.

Furthermore, the global fund spread is broadly consistent across both funds, as it should be:

Country Allocation

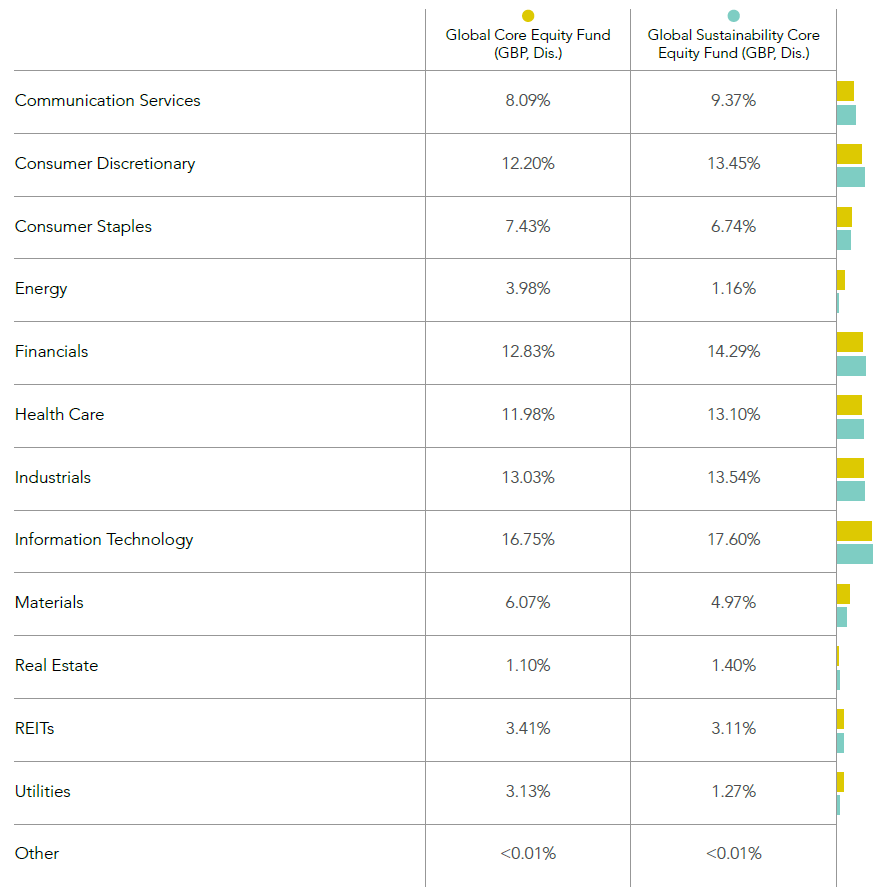

The main differences in these Funds are seen in the invested sectors where, as expected, energy, materials and utilities have a reduced allocation within the Sustainable Fund:

Equity Allocation by Sector

The fact that some companies in these sectors are still represented illustrates the effort to shift from high carbon emmissions and environmental damage to sustainable, clean, green energy production and delivery. There are energy companies who have transformed themselves into close to carbon neutral enterprises by being early adopters of sustainable energy production and who led the shift away from oil and gas exploration, production, and refining. It’s these companies that ESG research highlights and rewards by increasing their participation in portfolios.

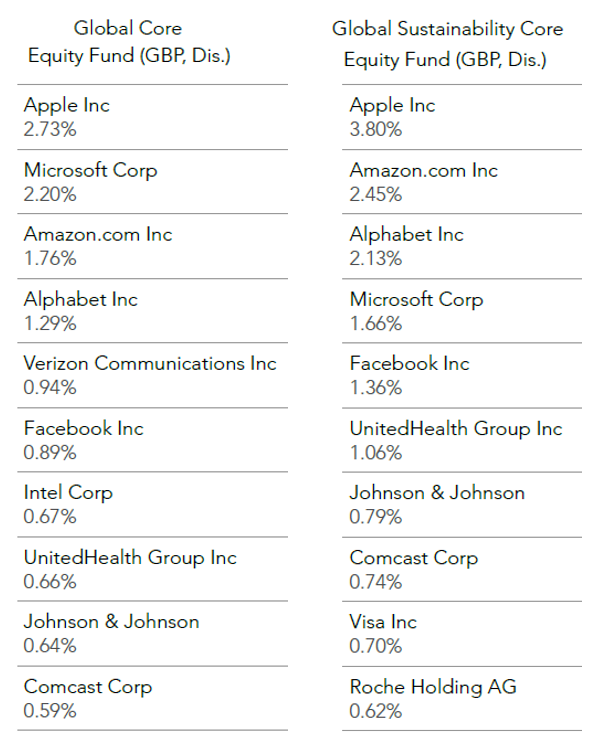

The largest companies in the world currently are: Microsoft, Apple, Amazon, Alphabet Inc, Berkshire Hathaway, Facebook, Alibaba Group, Tencent, Johnson & Johnson and Exxon Mobil. If we were looking at an index fund, or most actively managed funds they would all appear in that order. However, let’s look at the two funds:

Top Equity Holdings by Company

The promotion and relegation from a typical index fund we are seeing above in both funds is an evidence-based tilt towards smaller, value companies with higher profitability. The Global Sustainable Core Equity Fund, however, goes further and adds a balanced judgement of three main ESG principles. It rewards companies that demonstrate environmental concerns and actively promote carbon reduction in its operations. It goes further by assessing its labour record; how it treats its employees, suppliers, and the local communities, wherever they may be in the world. It also highlights differences in reporting standards; how open and transparent a company is about its approach to executive pay and rewards, whistleblowing, and financial reporting.

In conclusion, investor interest in ESG funds continues to grow, especially over the recent period of huge uncertainty where many fund groups saw large outflows as people tried to reposition or exit markets entirely. Funds which had already adopted ESG principles typically fared better, with more investors staying invested, as well as new money going in.

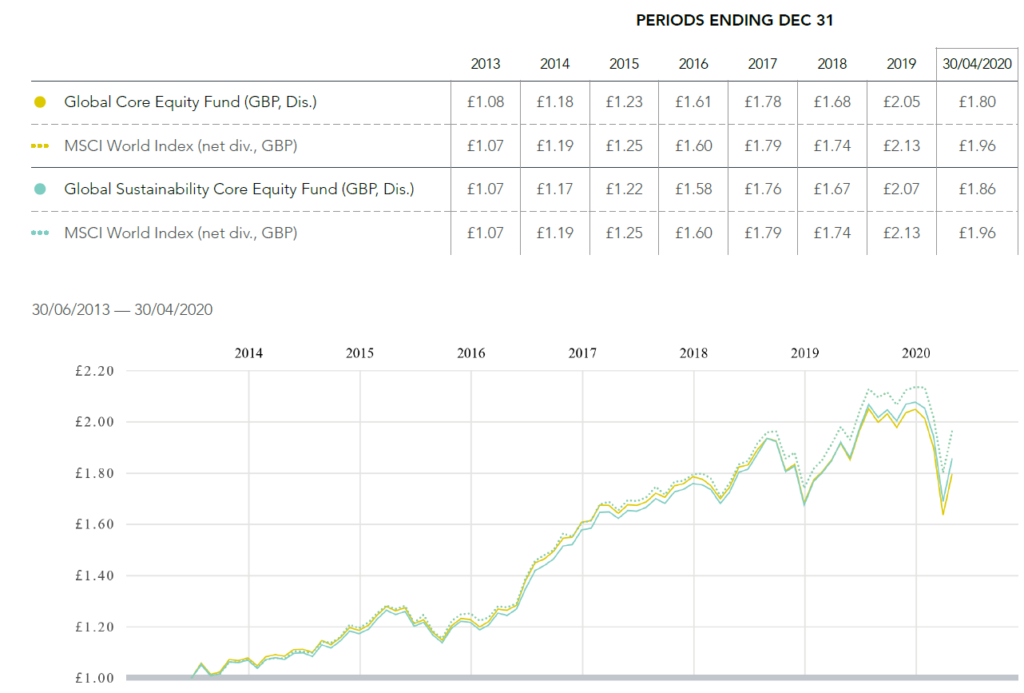

Finally, (well done if you’ve read this far…) here is the performance detail from both of the Dimensional Core funds over the past 7 years:

Growth of Wealth

Why have we not made any changes to our defensive or fixed interest fund components?

It is our clear intention to do so. However, as our philosophy states that our use of fixed interest funds is purely defensive, we are only researching funds that fit our specific requirements. Our preferred fixed interest funds are those containing high quality, short dated gilts or corporate bonds. At present, there are no individual funds matching those conditions we are comfortable investing in. The situation, however, is constantly changing and under ongoing review. When we identify funds that are consistent with our investment philosophy and objectives, we will undertake detailed analysis and research and communicate our findings to you.

This document is intended to provide information for existing clients of Stewardship Wealth on the subject matter. Any reference made to specific funds should not be construed as financial advice or a recommendation to buy or sell any investments. You should never make an investment without receiving appropriate advice or undertaking your own research. Stewardship Wealth clients will receive a personal recommendation based on their personal financial circumstances. It goes without saying, but as we know ‘investments can fall as well as rise and you may get back less than you invested’ as well as ‘past performance is no guarantee of future performance/returns.’ If you are not a Stewardship Wealth client and would like to know more about how we advise our clients, please contact us at: Hello@stewardshipwealth.uk