Who Knew 28th October Was National Chocolate Day?

At least in the US it was. However, it seems that it’s not all sweetness and light in the milky smooth world of chocolate. People are boycotting some chocolate brands, but not for health reasons. It stems more from moral outrage at the practices hidden beneath that seductive dark brown coating. I was reading a piece from Virtual Capitalist about the journey our favourite chocolate makes from cocoa plantation to supermarket basket and have borrowed some data from the article as it helps us better understand the growing importance of governance in the investment due diligence process.

Most of us can remember the food scandal where the ‘beef’ in some shops was not what we expected, neither was the ‘lamb’. It shone a light on the importance of provenance. Knowing what something was, where it came from, and that it was properly reared. If you recall, the financial fall-out created winners and losers. Waitrose was one of the winners. It appears they could tell you it was a real cow, that her name was Mabel, that she was born at a specific farm in Aberdeenshire, and that she ate grass from that field right over there.

Investment firms are adopting the same approach when it comes to corporate governance. They want to know everything about a company, not just how much money they make, spend or waste. They want to know how it all happens and they want the truth. It’s a, “Don’t just tell me, show me” kind of meeting.

Dimensional, our chief fund management partners, have recently released their governance update or Stewardship Report (no relation!). It is a significantly weighty document which demonstrates the lengths they go to dig deep under the skin of companies before they are selected for their investment funds, especially those carrying the Sustainable Funds label (see end of article for link).

We have written before about the growing influence of Environmental, Social and Governance (ESG) considerations. You may be wondering what all this has to do with chocolate, so let’s explore the world of chocolate and highlight some troubling issues from a social and environmental perspective.

As a $130bn a year industry, chocolate relies heavily on the labour of farmers in West Africa, especially from Cote d’Ivoire and Ghana, ranked one and two respectively in the global exporter league. Those farmers earn less than $1 a day.

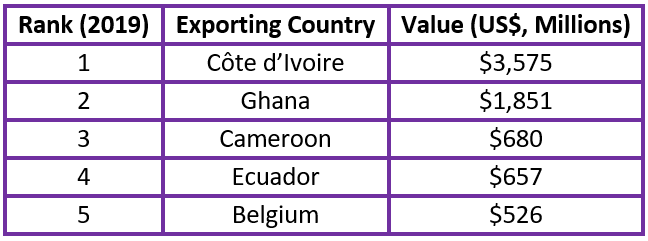

Chief Global Exporters of Chocolate:

Growing cocoa requires specific temperature, water, and humidity conditions which propels the equatorial regions of Africa, Central and South America, and Asia into pole position as optimal locations. Belgium’s appearance is due to the volume of ‘industrial chocolate’ exported to other producing countries. Industrial chocolate is essentially cocoa derivatives used in the production of chocolate products. In addition, Belgium is recognised as one of the major exporters of high-quality chocolate, as well as being home to the world’s largest chocolate factory.

Without farmers, both the cocoa and chocolate industries are likely to suffer from shortages, with a domino effect on higher overall costs. However, the farmers have little ability to influence prices at present.

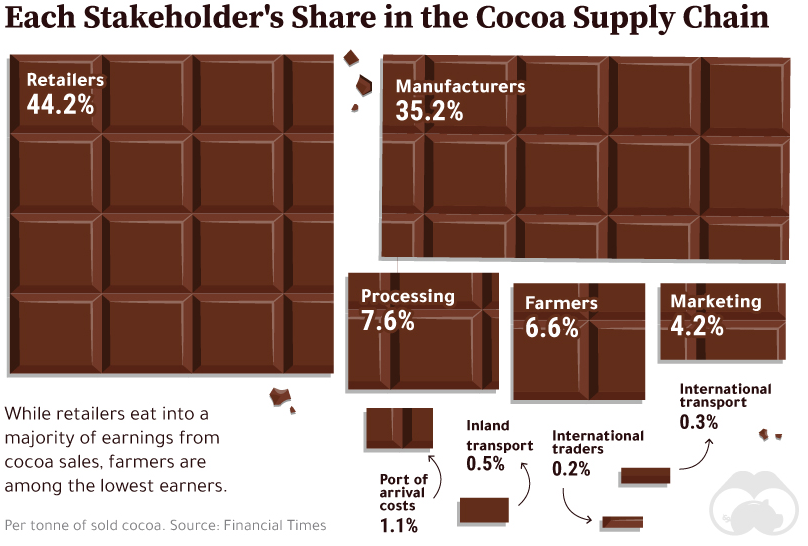

Farmers, despite their key role in chocolate production, are among the lowest earners in the chain accounting for just 6.6% of the value of the final sale. This creates a material imbalance in the financial returns for those local farmers who have to suffer the costs of farming with no influence on the price they may receive.

Farmers, despite their key role in chocolate production, are among the lowest earners in the chain accounting for just 6.6% of the value of the final sale. This creates a material imbalance in the financial returns for those local farmers who have to suffer the costs of farming with no influence on the price they may receive.

The Darker Side of Chocolate

Whilst the World Bank has set the benchmark for extreme poverty at $1.90/day, Ghana’s cocoa farmers make just $1/day, and those in Côte d’Ivoire make even less, around $0.78/day. The trickle-down impact is that children are employed, often in poor or dangerous conditions at little or no wages. It’s estimated approximately 900,000 children in Cote d’Ivoire work in cocoa agriculture, and 800,000 in Ghana.

Financial pressures on families and governments have also led to a rise in environmental and sustainability issues such as de-forestation and illegal farming.

So, what is being done about this?

Major global confectionary producers such as Nestle, Mars, and Hershey have moved to eradicate child labour in cocoa farming but have yet to reach their targets. Efforts from organisations such as UTZ Certified, Rainforest Alliance, and Fairtrade are directed towards better provenance so crops can be identified and shown to be from ‘certified cocoa’, sourced from farms that prohibit child labour.

While these initiatives have had some positive impacts, more still needs to be done to successfully eradicate large-scale child labour and poverty of those involved in cocoa’s supply chain.

How does this link with Environmental, Social, and Governance processes?

Companies are required to report clearly and openly their operational policies and practices when it comes to child labour including working conditions, community support, and educational support. The reputational damage that can result from shortcomings now go beyond newspaper headlines. They can result in a company’s board being identified, voted down, and major institutional shareholders selling their holdings.

As you know, Dimensional Fund Advisers are our key investment partner and we have been working with them to make sure we are aware of their policies and voting record when faced with these types of poor practices. We have created a link to the most up to date Dimensional 2020 Annual Stewardship Report (CLICK HERE) which outlines in significant detail how Dimensional handle all Environmental, Social and Governance reporting responsibilities. They make no apologies for the level of detail in their report which I find reassuring. No stone unturned is a reasonable summary!