It’s been said that we should “Eat to meet long-term goals, not short-term satisfaction.”

So, choosing between fruit or chocolate should be easy. But is it? Do we consider our dietary choices in terms of long-term health outcomes? I rarely considered food choices in that way until recently. I now have a list of things I’m supposed to avoid, which is annoying. Most of them are things I really enjoy. Lifelong health is important, yet most people would choose chocolate! Instant gratification trumps long-term benefit it seems.

Occasionally short-term circumstances can become the new normal, causing some people to change their long-term plans. Take the current inflationary environment. Should we change how we construct our plans in response?

When we translate your goals and ideas into a financial plan, inflation is a key constituent in our projections. After all, you should at least be able to maintain, but hopefully improve your purchasing power over the course of your life. So, should we increase the inflation rate in our cash flow projections? No, we shouldn’t, at least not for quite a while. Here’s why.

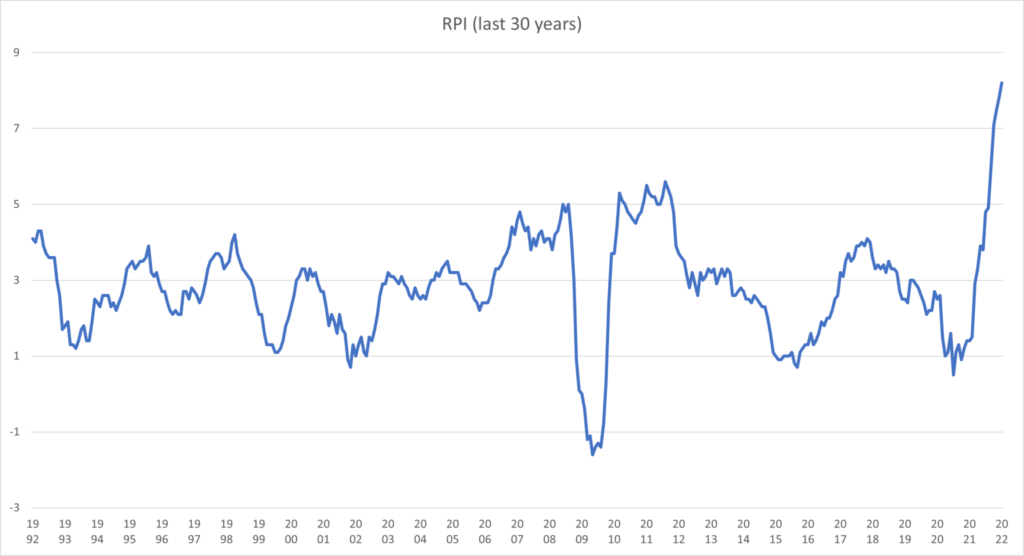

Our cashflow models reflect long-term expectations for markets, and inflation using decades of robust academic data. The average rate of inflation (RPI) over the past 30 years is 2.8%. The chart below plots the changes over time, but it’s the long-term average you need to consider, not the short-term movements.

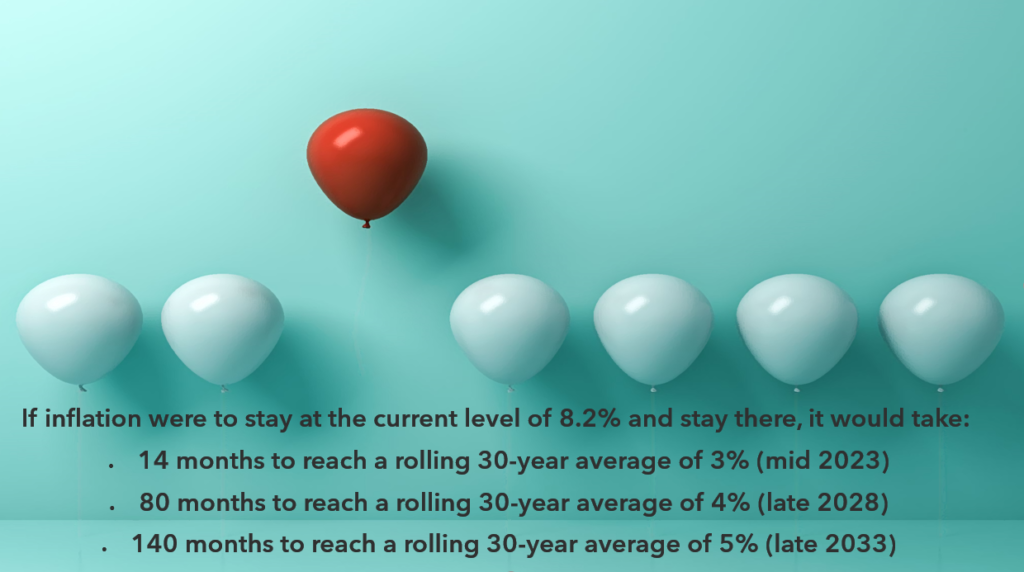

Inflation remaining at current levels for an extended period is very unlikely, but just in case, we have been asking ourselves questions such as “What impact is current inflation assumptions having on the client outcomes? What would cause us to change them?

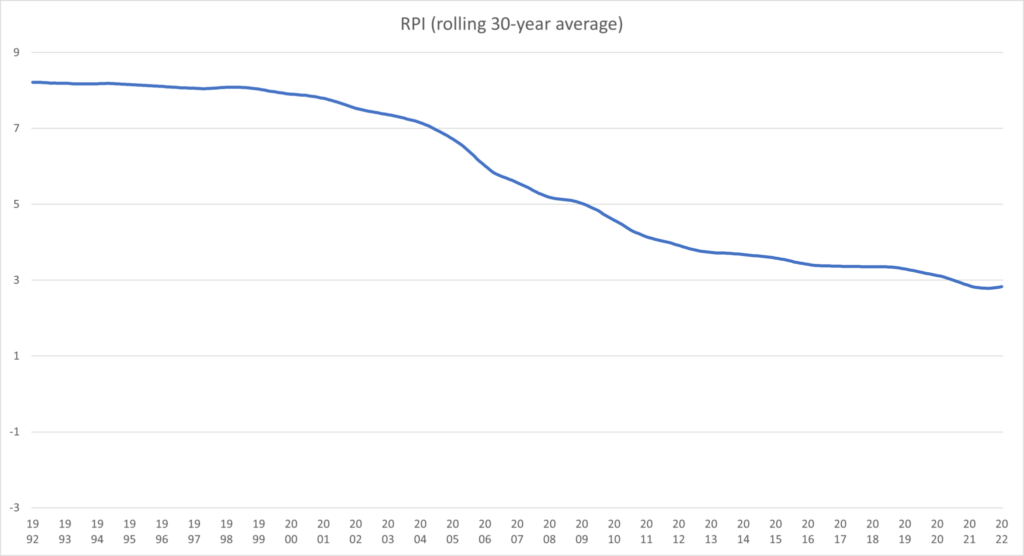

Our cash-flow models are long term illustrations and use long-term rolling averages. Here’s a chart showing 30 year rolling average inflation. Planning is by nature a forward-looking endeavour and financial plans are likely to run over several decades. So, it makes sense to use figures that reflect our experience over similar periods.

So, “How long would inflation need to stay at current levels for before we would need to increase our inflation assumptions from 3% to even 4%?” The answer is 80 months of RPI being at current 8.2% levels. Here’s a graphic demonstrating the impact of long-term high inflation and the effective tipping-points where cash-flow projections might require change.

Our first priority in any planning process is risk mitigation. Let’s make sure it does what we want it to. No surprises. We model extreme events and scenarios as they occur to ensure our expectations remain achievable. We won’t rush into anything; quick decisions have a habit of disappointing us far more than well-conceived and skilfully measured plans.