2020 pushed the boundaries of “normality” beyond any previous year in our lifetimes. Many initially struggled but found coping mechanisms that helped them through. Some took the opportunity to exercise which over time developed into a disciplined regime and in doing so not only increased their fitness, but allowed them to enjoy a new, healthier lifestyle.

Others, especially those isolating, had to contend with limited family contact and personal meetings that were limited to screens and phone calls. Those with gardens found a new love for pottering around outside. It became their “happy place”.

Some people became twenty-four-hour news junkies, at least until they realised their lives were submerged in the media mood music which made Leonard Cohen seem like a feel-good party option.

Financial market reports became part of the unrelenting media noise with reports of markets spiralling out of control and continuing uncertainty sure to make things worse. Financial markets simply carried on doing what they have always done. They feed all available information into one end of the “data sausage machine” and market prices come out the other. In reality, nothing changed. Markets continued to reflect the expected future returns from stocks and shares, government and corporate bonds regardless of any backdrop.

I wanted to explore the potential outcomes for those who couldn’t turn down the media noise on markets and believed they should “do something” to try and stem the losses.

So here is a case study for your consideration:

Scenario A:

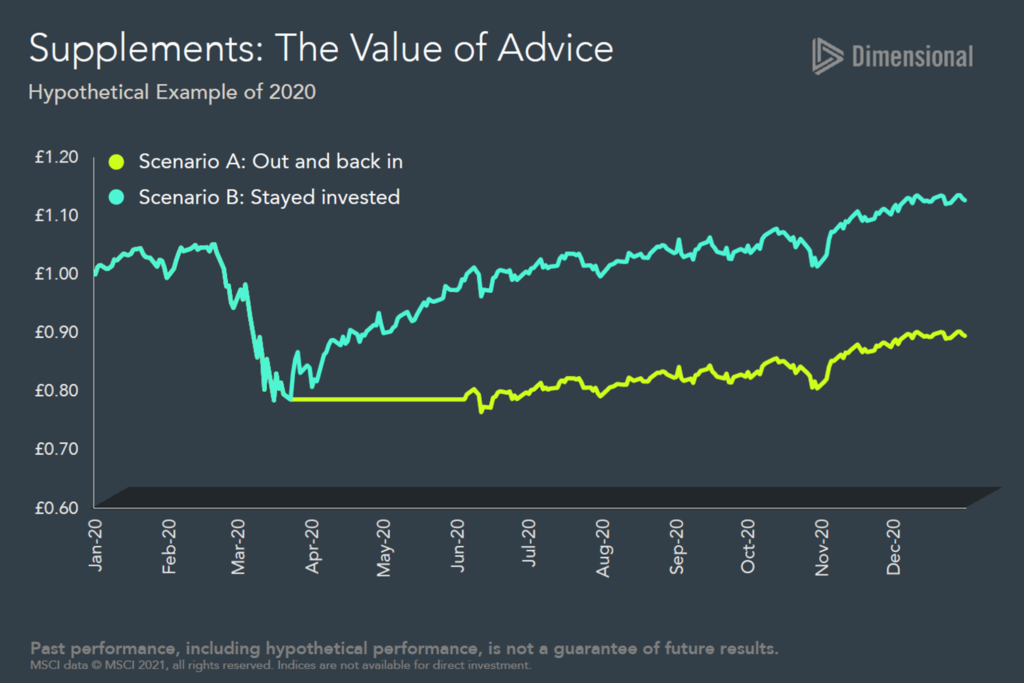

A client has £1,000,000 invested in a globally diversified portfolio at the beginning of 2020 (Let’s use the MSCI All Country World Index as a proxy). At the beginning of March last year, he had lost over 20%, some £213,942.

Fearful of further losses he sells out with the intention of buying back in only once the markets have recovered. In this case he re-invests on June 5th when markets had risen back to its original level. At the end of December 2020 his £786,058 (the original sale proceeds) are now worth £894,909.

Scenario B:

A client talks with his adviser and shares his concern over the possibility of further heavy losses. After several conversations, revisiting the financial plan, re-running the cashflow model, and testing the investment portfolio, the client agrees with his adviser and stays invested. His portfolio at the end of December 2020 is worth £1,126,659.

The difference or ‘opportunity cost’ is £231,750 for clients who, despite the obvious conflicting emotional pressures, decided to remain disciplined and stuck to the plan. Another thing to bear in mind is that the increased value compounds going forward making it impossible for the Scenario A client to catch up. Here is a chart that shows the impact:

As you all know we are completely comfortable with the fact that we cannot predict, outguess, spot patterns in markets or calculate the movement and direction of prices. We also know the dangers and costs of trying. Clients have seen the benefit of sticking with the original plan over the last twelve months as markets quickly reversed the initial sharp losses.

The value of advice in these situations cannot be overstated. Sometimes the only thing that comes between a client and a poorly judged decision is their adviser.