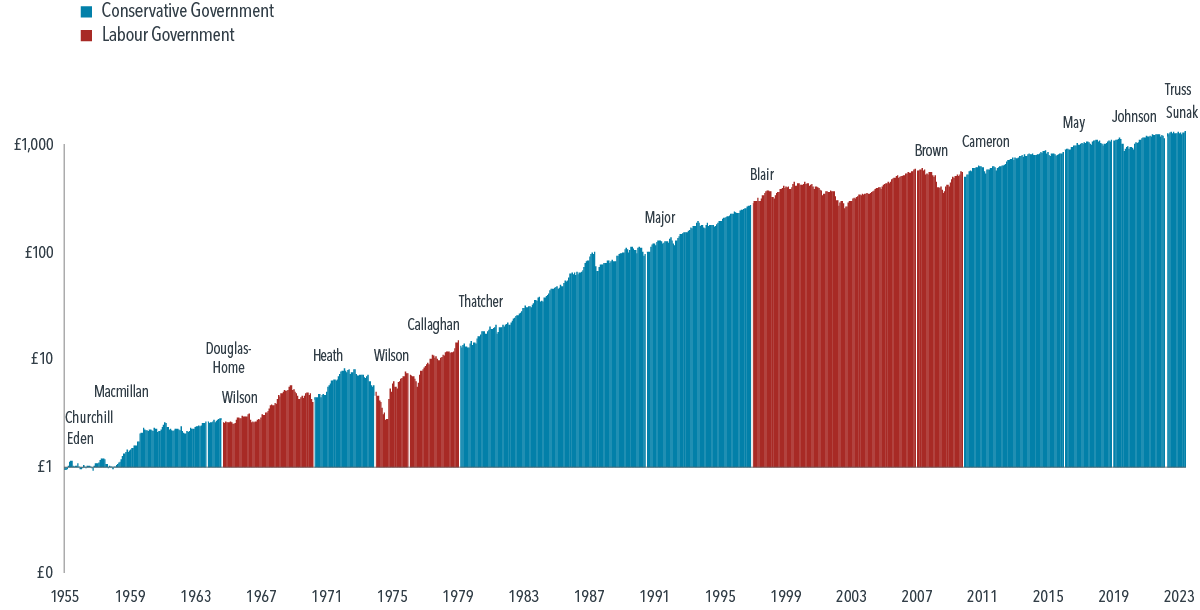

The UK election may have some investors looking to change their portfolios. They should think twice. Decades of returns over 17 prime minister’s tenures of 10 Downing Street suggest long-term investment values continue to rise regardless of who wins.

Why?

There are many factors that impact markets; the economy, interest rates, inflation, currencies, geopolitical tensions, energy prices, and many more. The ideology and policies of a particular political party matter little, it seems, based on the evidence shown below.

EXHIBIT 1

Growth of a Pound Invested in the FTSE All-Share Index

January 1955–December 2023

Source: Dimensional

Interestingly, research from St James’s Place (SJP) the UK’s largest wealth adviser shows significant numbers of clients intend to change their investment portfolios due to the forthcoming election. The most concerning results relate to younger less experienced investors.

• 81% of those aged between 25-34 plan to adjust their portfolios.

• 74% of 45–54-year-olds and 85% of those over 55 said they will do nothing.

• Novices with less than a years’ experience, are more than three times as likely (62%) to react to the general election than those who have been investing for a decade (19%).

The chart above highlights the importance of staying focussed on the long-term. Investors should ignore the siren calls to change their portfolios based on speculation. Second guessing the market rarely works. Markets are likely to continue to rise irrespective of which party controls our parliament just as they have done over the past 70 years.

Talking to a financial planner is probably the only change they should make.